This article will give Web3 product designers an understanding of the various Web3 token categories and emerging use-cases. Stay tuned for future Web3 Design Courses where we deep-dive into products in the Web3 ecosystem.

As you may have heard there are literally thousands of Web3 tokens in existence today – some native to cryptonetworks, and some launched on top of these cryptonetwork. This vast token landscape can be broken into two high-level categories: utility tokens and security tokens.

Utility tokens are by far the most common Web3 token. These tokens are used to access cryptonetwork services. Ether is a good example of a utility token, because it is used to pay for using the Ethereum blockchain. In other words, users pay ether to Ethereum nodesfor processing their transactions. All smart contract blockchains have a native utility token like this. Ethereum is a general purpose cryptonetwork that can run all sorts of dApps; however, there are other specialized cryptonetworks. Just as an example, Sia and Golem are cryptonetworks that provide decentralized cloud storage and cloud compute, respectively. Users of these cryptonetworks redeem SiaCoin (SC) and Golem Network Tokens (GNT) to utilize these decentralized services.

The other major category is security tokens. Securities in the traditional finance world include things like stocks and bonds. Organizations issue securities in order to raise capital, whereas investors purchase securities with an expectation of some return over a period of time. These investment vehicles are regulated by the SEC in order to protect investors from fraud and ensure fair, efficient markets. Security tokens are registered securities that are transacted on the blockchain for faster and cheaper settlement, and more transparency compared to traditional markets. Organizations have already begun issuing stocks and bonds on Ethereum. Other security tokens are backed by real-world assets like precious metals (PAXG), commodities (XPD), and real-estate (IHT).

Notice the difference between utility tokens and security tokens when it comes to regulation. Security tokens play by the rules of traditional capital markets and willingly undergo government regulation during their launch; whereas, issuers of utility tokens claim that their tokens are not securities and, therefore, do not need to comply with securities regulations. The SEC, led by Gary Gensler, largely disagrees with this claim – he says the vast majority of “utility tokens” appear to him as unregistered securities. This is one of the great tensions between the US government and Web3 at the moment, and we’ll see later in this article.

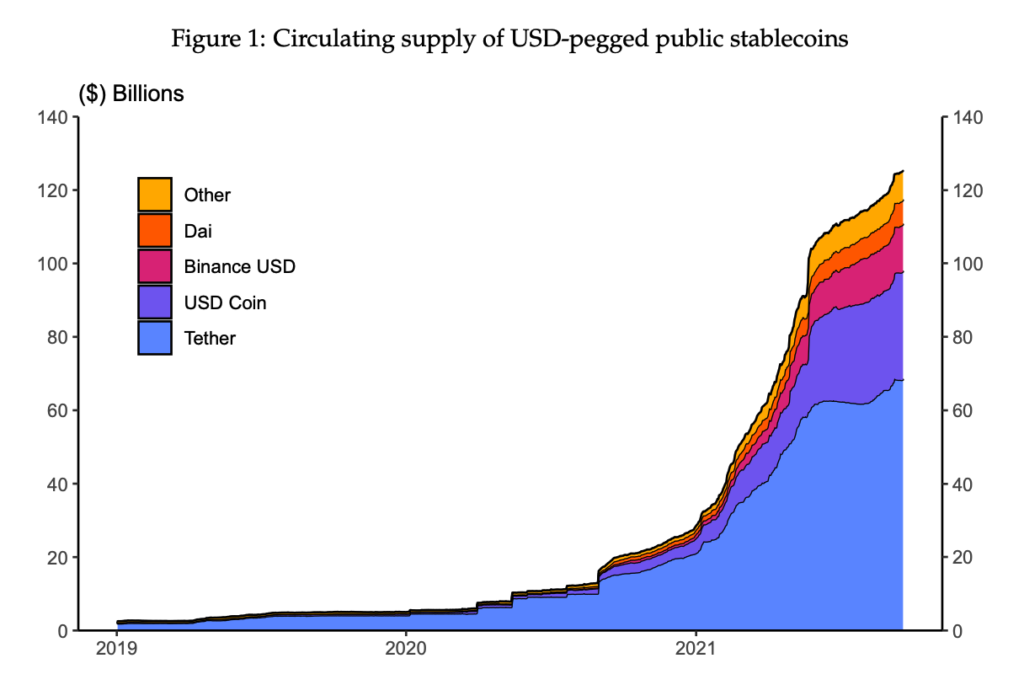

It’s difficult to place stablecoins in either of these token categories, but they deserve an honorable mention as they grow more and more popular. These tokens are designed to maintain a stable value over time. This makes stablecoins more attractive as a medium of exchange compared to other Web3 tokens that experience high price volatility. Usually, stablecoins are pegged in value to a fiat currency like the US Dollar. For example, the two most popular stablecoins – USDC and USDT – are fully-backed by US dollar reserves held in traditional financial institutions. These are called fiat-collateralized stablecoins; however, there are other emerging stablecoin categories such as crypto-collateralized (e.g. DAI), and algorithmic stablecoins (e.g. OHM).

Now, let’s go back to utility tokens. There are many sub-categories of utility tokens, and it’s difficult to fit any one token into a single category – they usually belong to multiple categories at once. Below I list some other use-cases of utility tokens, nost as an exhaustive list, but to give you a flavor of the experimentation that is being done on token design.

- Governance: Allows users to submit, and vote on, improvement proposals for protocol upgrades. They first came onto the scene with some of Ethereum’s popular DeFi protocols (i.e. Compound, MakerDAO, and Uniswap). These DeFi protocols distributed their governance tokens to their users, effectively decentralizing the governance of the protocols. Now token holders have significant influence over the evolution of the protocol, not just the core development team.

- Cashflow: Earn a portion of the protocol’s revenues – this is often called “staking”. For example, most smart contract blockchains allow users to stake the cryptonetwork’s native token, and earn block rewards for doing so. Also, UNI token holders receive a portion of the swap fee that Uniswap charges for facilitating token swaps.

- Discounts: This is a common use-case on crypto trading platforms. For example, holding CEL token gives users preferential interest rates when lending/borrowing on Celsius Network, and BNB and FTT get users discounted trading fees on Binance and FTX, respectively.

- Gaming: Most Web3 games have in-game currencies that can be redeemed for in-game items. For example, virtual animals can be bred with one another using SLP token in Axie Infinity. Also, MANA is consumed in oder to generate land plots in Decentraland’s metaverse.

- Social/Community: The most obvious use-case here is with social media influencers who launch a token backed by their own reputation (see Rally). Social tokens give patrons a direct way to support celebrities, influencers, and artists while enjoying additional benefits like access to exclusive content, entrance into in-person events, access to private online communities, and more.

So these are the Web3 token categories, and some of their use-cases. Let’s now talk about token launches, and some of the problems associated with token launches. We’ll eventually get into the regulatory issues surrounding Web3 tokens.

If you enjoy videos over reading when it comes to online learning then checkout the course on YouTube. This is part 4 of 7 in the Crypto Design Trends 2022 series. Also, make sure to stay tuned for future Web3 Design Courses where we will get into more interesting topics about emerging dApps.

0 Comments