Crypto is the currency of the Web3 ecosystem, and is required to access decentralized applications. So how do users first get cryptocurrency? This is where crypto exchanges come in. In this post we’ll show the UX design trends, and patterns, of crypto exchanges in 2022. This is just the beginning of Web3 tutorials for product designers. Stay tuned for future Web3 Design Courses where we discuss emerging dApps that will disrupt the internet as we know it today.

Exchanges are known as the “on-ramp” to cryptocurrency, because it’s where users convert their fiat currencies into cryptocurrencies. Let’s talk about the user journey for onboarding to crypto exchanges, and purchasing cryptocurrency on them. Product designers put a large emphasis on crypto exchange onboarding, because the UX has been bad in the past and user friction still exists today.

Before writing this, I onboarded to four crypto exchanges (Coinbase, Kraken, Crypto.com, and Gemini), and tested the user experience of each. Coinbase by far had the best UX of all crypto exchanges I looked at. It’s one of the most mature Web3 companies as it has been running since 2012, it went public in 2021, and it continues to build a robust team of UX designers and researchers. In my opinion, Coinbase is the gold standard of crypto exchange UX at this time.

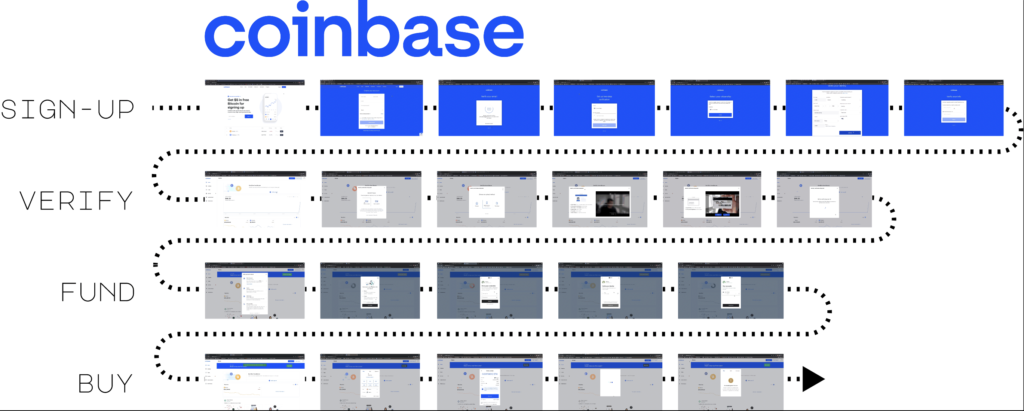

Before we get into the specifics, understand that the user flow is broken into four phases on all exchanges: sign-up to the exchange, verify your identity to meet government KYC/AML requirements, transfer funds from your bank account to the exchange, and, finally, purchase crypto.

Sign-up is similar to other web services. The user creates an account with an email username, and sets a password. They receive email verification, and text verification for 2FA. Nothing abnormal yet.

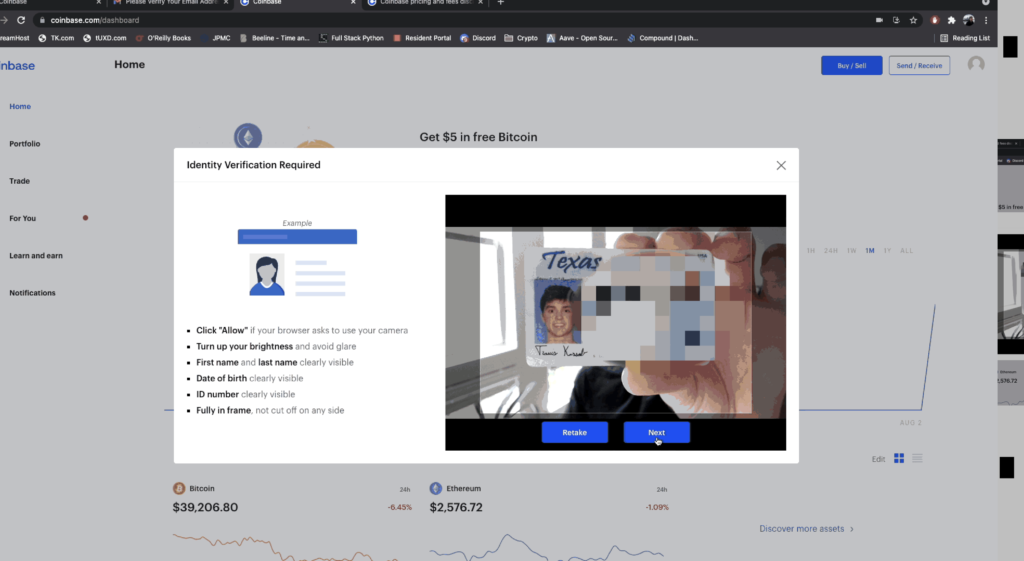

The UX starts to degrade in the next phase where the user must verify their account. In other words, the user must prove their identity using government issued documents (i.e. passports, drivers licenses) in order to use the exchange. This account verification has to do with the exchange complying with KYC (Know-Your-Customer) and AML (Anti-Money Laundering) regulation. Basically, the exchange is considered a bank, and governments want to control who has access to these banking services.

Most would agree that we shouldn’t let terrorists, criminals, and other sanctioned individuals use banking services; however, for the average user, this account verification step poses a couple problems. First, account verification requires the collection of sensitive information like residential address, social security number, and government-issued documents (e.g. passports and driver’s licenses). I think we all know privacy-conscious people who wouldn’t feel comfortable providing this information to a crypto exchange, and submitting it over the internet for that matter. Looking at you mom and dad.

Also, users are not told how long the account verification process will take. Admittedly, it only took one minute for me to receive a confirmation email from Coinbase, but this could still prevent people from setting up an account and purchasing crypto all in one sitting. Kraken and Crypto.com took 5-10 minutes for account verification. My account verification on Gemini is still pending, over 6 months later.

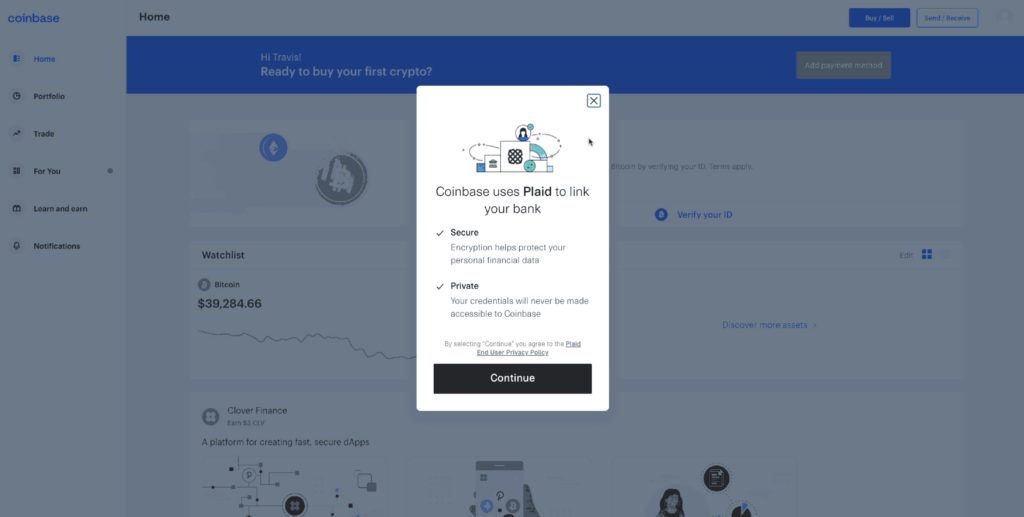

Now, the next step in this journey is for users to connect their traditional bank account to the crypto exchange. This has to do with landing fiat currency into the crypto exchange so that it is available to purchase the cryptocurrency with. Exchanges provide a variety of transfer methods, such as ACH transfer, Bank Wires, PayPal, and Debit cards. These methods differ in terms of transfer limits, transfer fees, and how long it takes to land fiat in the account.

Coinbase integrates with a third-party service called Plaid to make the ACH transfer process more user-friendly. Connecting my bank to Coinbase via Plaid took only 30 seconds, and I was ready to purchase cryptocurrency from there. This is where Coinbase really starts to set itself apart from the others. When using the other exchanges, I was forced to open a new browser tab, log into my bank account and manually initiate bank wire transfers into the exchange. I was not charged any fees; however, the funds took 24-48 hours to land in the exchange. You can imagine how much more this disrupts the user flow compared to Coinbase’s seamless ACH transfer.

Finally, once fiat has landed in the exchange, the user is able to purchase cryptocurrency. It’s a simple process on all exchanges. The user selects which cryptocurrency they want to purchase and how much of it, denominated in their fiat currency.

If you enjoy videos over reading when it comes to online learning then checkout the course on YouTube. This is part 2 of 9 in the Web3 Design Course 2022. Also, make sure to stay tuned for future Web3 Design Courses where we will get into more interesting topics about emerging dApps.

0 Comments